Only Possible on Vest

Vest Exchange’s design allows for the creation of liquid and secure perpetual futures markets for traders and sustainable and compelling returns for liquidity providers. In addition to this, Vest also creates the possibility for additional software to be built on top of the infrastructure to offer additional products that haven’t been appropriately executed elsewhere.

With Vest’s zkRisk engine, offerings like structured products, new markets, and more can all be easily provided. Vest’s superior LP experience and returns can be used to create custom-built strategies backed by one of the most sustainable yield sources in DeFi.

Due to Vest’s composability-first software approach, all of this can be feasibly built by any individual or team with an idea. Building on top of Vest will be entirely permissionless and open. Teams interested in trying something new or even adding more robust infrastructure to an existing product will be able to leverage Vest as they please.

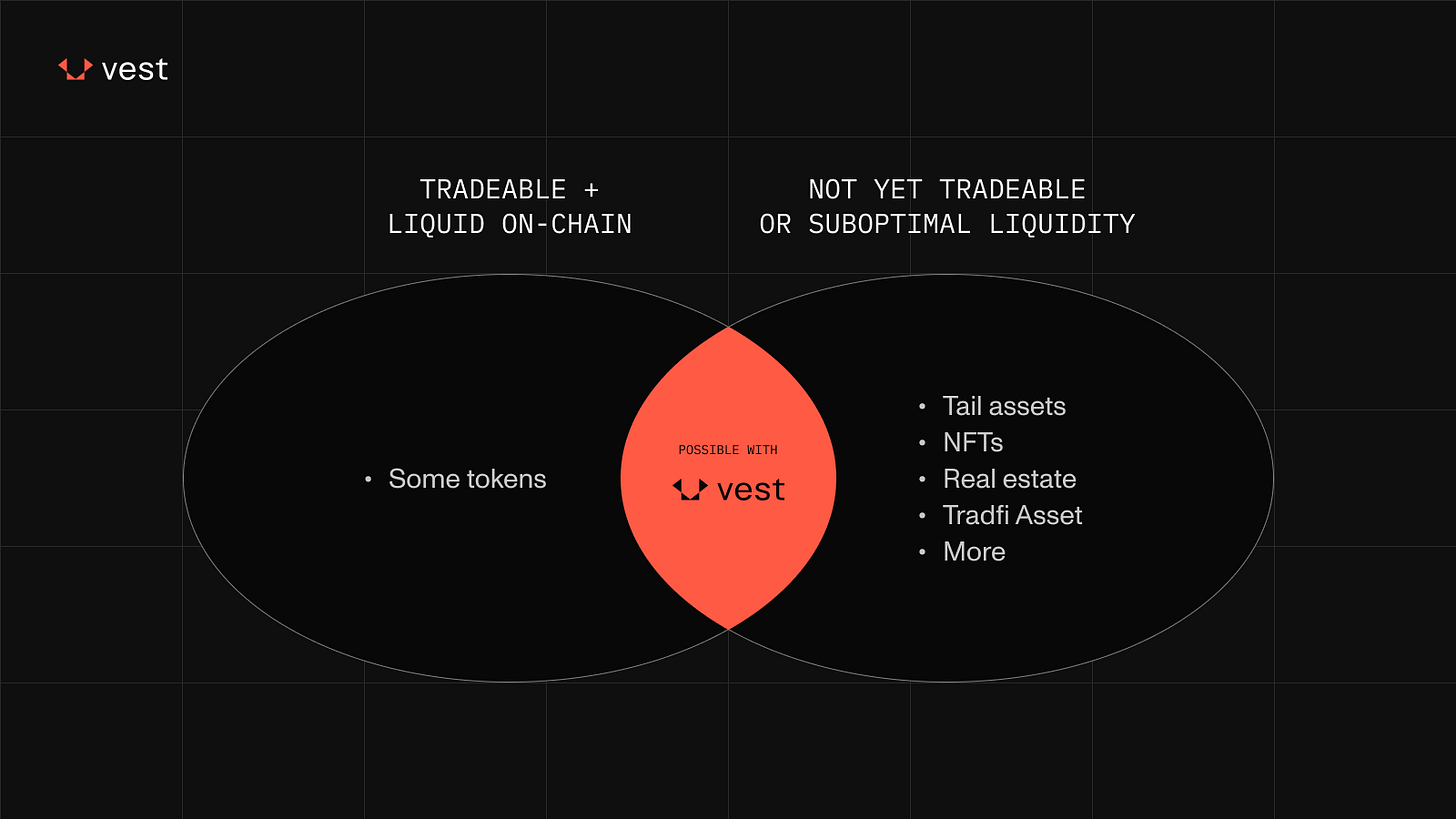

New Markets

Protecting LP capital and the overall system from insolvency in all market conditions without capital limitations has the benefit of quickly listing any asset with a price feed on Vest. This means that a new class of assets can easily offer perpetual futures on Vest. Vest can be a hub for perp trading against tail assets, NFTs, real estate, bonds, forex, commodities, and other real-world assets (RWAs) on zkSync.

Vest can offer these assets because the risk engine does not need direct asset backing for every trade. This can have the unintended consequence of putting too much risk on LPs and the AMM due to the volatility of illiquid assets. Still, Vest mitigates that risk by charging traders for executing trades that increase risk and compensating LPs with those additional fees, or Premia. In addition, the AMM buffer between LPs and traders creates a cushion that lets LPs gradually generate fees proportional to any risk they take without compromising their initial capital deposit.

Most NFTs, tail-end digital assets, and RWAs don’t have any derivatives markets to trade - on-chain or elsewhere. The few existing markets are limited in many ways and/or have backfired on users and LPs in the past. With Vest, traders will be able to access these markets and more with fewer limitations and more liquidity than previously was possible.

Structured Products

Early simulations of Vest’s LP offering predict a potential return well into the triple-digit APYs. Unlike most LP opportunities backed by perp DEXs, this figure is largely agnostic towards trader PnL, making it one of the market’s most delta-neutral high-yield LP opportunities. Given such a high baseline, creating strategies backed by Vest LP positions opens up a world of possibilities. Long/short delta strategies that carry a directional bias can be developed, allowing users to earn high yields while also getting exposure to the price of certain assets.

Combining a Vest LP position with a long/short bias to anything from specific assets to volatility to create more sophisticated structured products for users. Starting with a position that yields three-digit APY while keeping most of the capital risk-off, strategies built with a Vest LP as one leg of the equation start with a higher baseline than any others. Strategies like this will also serve as a net positive for the Vest ecosystem, deepening liquidity for traders and allowing the platform to scale with greater demand and assets.

Cross-Product Margin

Vest’s zkRisk engine is great for creating a risk-adjusted environment for perp trading, but it doesn’t stop there. The framework monitors the risk of the entire exchange, meaning any number of products can tap into it. This means that anyone can permissionlessly create a myriad of new products, such as options trading, money markets, and spot trading, while tapping into Vest’s risk framework and deep liquidity. This has the key benefit of composable liquidity for any products in the Vest ecosystem, allowing for a myriad of new usecases.

Positions on Vest perps could be used as collateral for a loan. LP positions could be used as collateral to open positions for options. Active limit orders can rest in Vest’s money market, earning yield while the user waits to be filled. The end vision for Vestis to create a fully composable and cross-margined DeFi ecosystem - where every product is risk-indifferent for LPs and infrastructure, liquidity is composable across said products, and users can make use of them with little to no restrictions.

Sky is the Limit

The above solutions presented only scratch the surface - the possibilities the broader Vest ecosystem will provide are endless. Stablecoins could be built and backed by Vest LPs so that they are naturally yield-bearing. Different perp-based stablecoin models could be built with Vest perps as a backing as opposed to LPs due to the higher liquidity and security available. Composable Vest LP positions could be used as collateral in money markets, freeing up liquidity within the ecosystem.

The possibilities are limited by user demand and builder imagination. Offering an innovative space for users to trade a wide variety of assets and for LPs to earn yield like never before also opens up the possibility for brand-new ideas that have never been seen before. If you’ve got such an idea, discuss it with other like-minded users on our research forum. Any updates, news, and additional info on Vest can be found first on our X and Discord.