Capital Efficiency without Insolvency

On-chain perpetual futures markets represent a revolutionary advancement in technology for global finance. Since Bitmex first announced XBTUSD perpetual futures in 2016, crypto traders and developers have contributed to ongoing innovation and technical advancements in trading perps.

Perpetual futures decentralized exchanges (perp DEXs) now exist across various blockchain networks, each with a distinct set of modifications and tradeoffs. However, these DEXs face significant shortcomings as they are forced to trade between speed, decentralization, liquidity, and safety.

The Vest exchange is the culmination of the team’s efforts in addressing these core challenges. Vest redefines the paradigm, not by offering incremental improvements but by implementing capital-efficient pricing for traders and LPs, introducing a novel funding rate mechanism, and eliminating open interest (OI) caps.

The resulting platform represents a convergence of safety and efficiency, providing traders with fewer limitations and a broader range of options, all within a secure and reliable ecosystem where solvency is guaranteed by mathematical principles.

Vest champions a security-first strategy, ensuring traders benefit from robust protection without compromising capital efficiency.

Where We Are

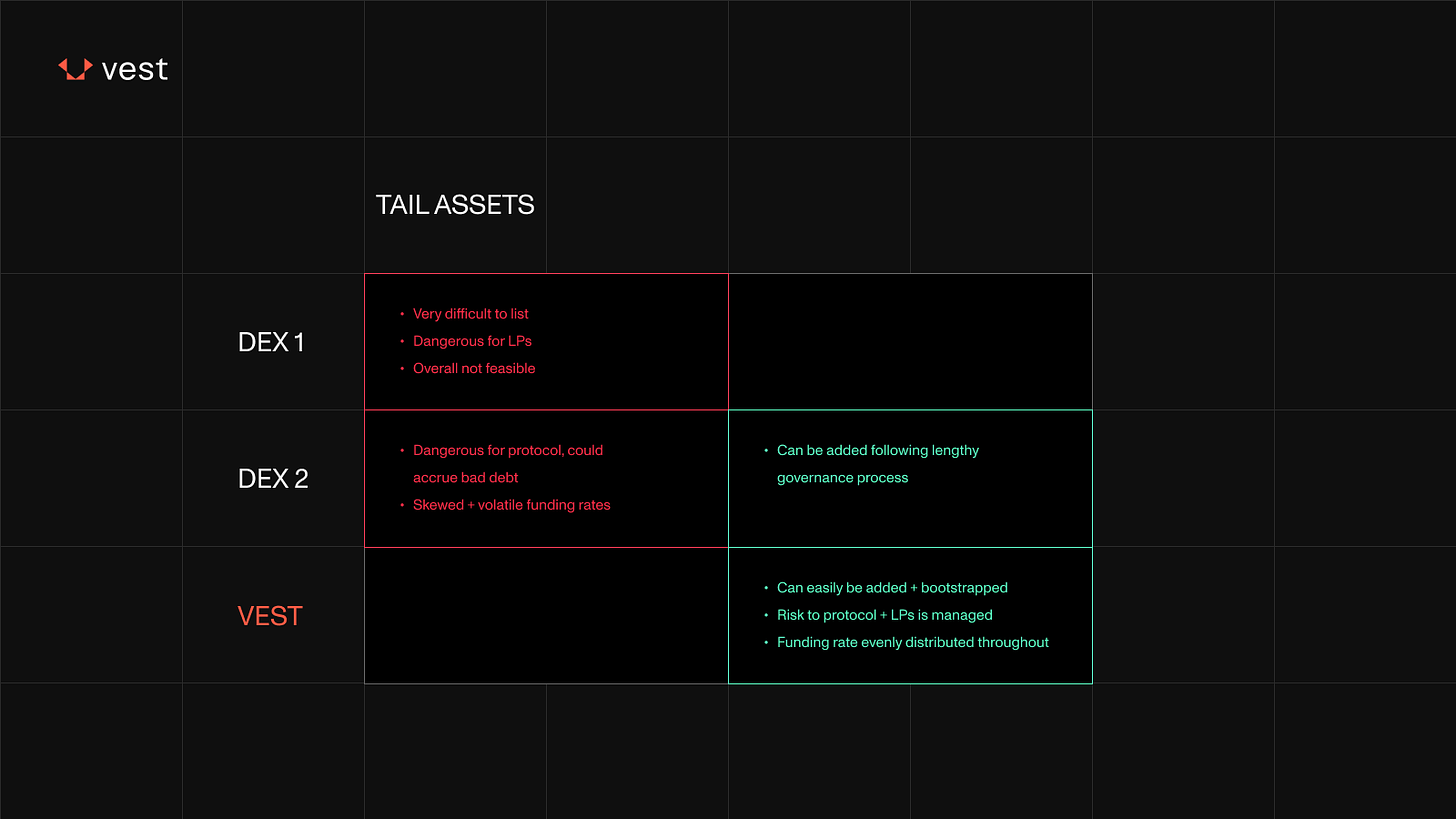

The perpetual futures space looks vastly different from what it did a year ago. Modern DEXs employ broadly similar approaches but on various chains or with slightly different design principles. To better illustrate how Vest will revolutionize the currently available trading options, let's look at two types of DEXs common in today’s landscape.

DEX A: Uses a multi-asset pool backing, where the amount and type of each asset available dictates OI caps and assets available for trading.

DEX B: Uses single-asset backing that serves as a debt pool for minting synthetic assets, where governance dictates OI caps per market.

DEX A can offer liquid trading against any assets supported in its liquidity pool. These are usually limited to a handful of popular assets - each can only provide as much OI as TVL in the liquidity pool. This limits capital efficiency but protects the protocol from most insolvency risk. DEX B can more easily add new assets so long as a proper risk analysis is conducted and agreed upon via governance. However, this also limits the capital efficiency of the more popular assets, as there is no risk segmentation between higher-risk and lower-risk assets - all are backed by a debt pool consisting of a single asset (usually a stablecoin). In addition, this creates contagion risk for the protocol - as all assets are backed by a single pool. OI caps help mitigate this, but truly scaling to meet demand (in pure volume and asset variety) is near impossible.

Funding rate calculations can also be a point of friction for traders on both DEXs and a point of risk to the overall system. Common funding rate mechanisms fail to adequately distribute risk throughout the system, incurring price risk for the assets being held by LPs. In addition, funding rate can quickly flip in volatile markets, hurting funding rate farmers and longer time frame traders. These mechanisms generally work by applying a coefficient of imbalance to a given market's long/short ratio and then charging an equal funding rate to all traders that gradually increases as long as OI remains skewed in one direction.

Vest

Vest's zkRisk engine ensures that traders can trade any assets with higher capital efficiency (no OI caps), low risk of insolvency, and more dynamic funding rate calculations to protect traders and the protocol. The protocol can be undercollateralized with minimal risk to LPs and full profit realization for traders. This is done by mathematically calculating risk for any given trade and using those calculations to increase/decrease the cost of trading for a given asset. This maintains risk indifference across any number of markets to keep inventory risk to a minimum without limiting traders. The increase in the cost of trading is known as Premia.

Most dexes today require user fees to be wholly arbitrary, not properly compensating LPs for the risk they take on and thus preventing the system from scaling due to improper risk adjustment. Vest’s zkRisk engine optimally aligns interaction between traders, LPs, and the exchange such that each one is able to act in their best interests without harm to any other. This also makes it easy to list new assets. Since risk is mitigated on a per-asset basis depending on the market skew, the system (as well as LPs) are properly compensated for the inventory risk they take on for holding certain assets.

Vest’s zkRisk engine also calculates funding rate in a way that’s safer for the protocol and more friendly for traders. The same risk measure (EVaR, Entropic Value at Risk) used to calculate Premia, is also used to calculate risk for funding at any given time. Given that funding is charged with respect to time rather than on open/close, this risk measure is continuously calculated every second. This measure, calculated for the entire exchange, is split across markets via Euler Allocation and then across traders based on how much OI they own within that market.

This creates a system where the amount of funding needed to account for inherent risk is calculated every second and dynamically readjusted. This gives traders a continuous and smooth funding rate and gives the exchange another risk mitigation mechanism.

Vest provides a security-first approach to traders that doesn’t require tradeoffs in capital efficiency. Via the zkRisk engine, traders can enjoy leveraged trading with peace of mind that their PnL, Vest, and LPs will all remain secure and solvent. More information on Vest and how users can get involved in creative ways is yet to come - We encourage anyone looking for further information to check out and participate in our research forum. Any updates, news, and product features can be first found on X and in our Discord.